Florida’s Best Public Adjusters Spoke with Stephen on a Saturday. He referred me to a local adjuster who also picked up on a Saturday morning and was willing to spend a good amount of time on the phone reviewing my concerns regarding a potential insurance claim on a flat-roofed home. He actually was so thorough that he talked himself out of a consultation and a fee. These are good people that are up front and honest . . . difficult to find these days. They have my whole-hearted recommendation.

PUBLIC ADJUSTERS

Residential & Commercial

Years

Of Experience

Claims

Completed

Total

Rescued

30+

Years Of Experience

731+

Cases Solved

$10,000,000+

Total Recovered

Free Policy Review

After the free consultation, we will review your home or commercial insurance policy to understand how to fairly get the most out of your claim.

Fully Licensed

Our licensed public adjusters are dedicated to you and responsible for maximizing your settlement of your new or underpaid insurance claim.

Available 24/7

Call us anytime at your convenience. Our private adjuster team delivers quality services, backed by expertise and experience.

One-On-One Attention

Our public adjusters give you the time and dedication you deserve. We can schedule a no obligation meeting at your property to get your claim started.

FREE CLAIM ANALYSIS

Once we establish we can help you, and its in your best interest to file an insurance claim, we will schedule an onsite inspection. Speak with one of our adjusters today to start your insurance claim!

We are available 24/7!

WHAT IS A PUBLIC ADJUSTER?

At Florida’s Best Public Adjusters we will make sure you get every penny of your insurance claim. Our team of public adjusters, private adjusters and independent insurance adjusters will walk you through the insurance claim process, fight for your rights and work hard to get you the maximum settlement.

Underpaid Or Denied Insurance Claim? Meet The Public Adjuster…

A public adjuster is your advocate through the insurance claim process. Unlike an adjuster working for an insurance company, a private adjuster or independent insurance adjuster works for you. Our licensed adjusters are knowledgeable in policy details, claims process and negotiating on your behalf.

How Can a Public Adjuster Help You?

Why Choose a Public Adjuster, Private Adjuster, or Independent Insurance Adjuster?

Insurance Expertise: Our public adjusters and independent insurance adjusters are policy experts.

Streamlined Process: No more claim stress; we will handle everything for you.

Proven Results: One of our recent cases turned a $13,000 insurance offer into $175,000 settlement!

Let Florida’s Best Public Adjusters guide you with expert advice, whether you need a public adjuster, private adjuster or independent insurance adjuster. With us by your side you can get what you’re entitled to.

NO RESULTS, NO CHARGE

If your home or business has been damaged or your claim has been underpaid, call us for a free consultation. We will negotiate with the insurance companies to obtain the maximum settlement.

Our public adjusters in Florida will file all proper documentation and go to the depositions on your behalf.

We work for you not the insurance companies. We have a team of highly experienced professionals who are here to help adjust your claim.

Florida's Best Public Adjusters

At our firm, we’re aligned with your objectives – securing the highest possible financial restitution for the damage sustained by your property or enterprise. Our team of Public Adjusters are dedicated to optimizing your insurance claim’s value.

Notably, we hold the top spot in Google Search rankings as the leading Public Adjuster. What sets us apart is our unwavering commitment to serving your best interests, as we work exclusively for you, not the insurance provider. Our mission is clear: to assist you in fully maximizing your insurance claim.

Stephen Lippy

CEO & Founder of Florida’s Best Public Adjusters

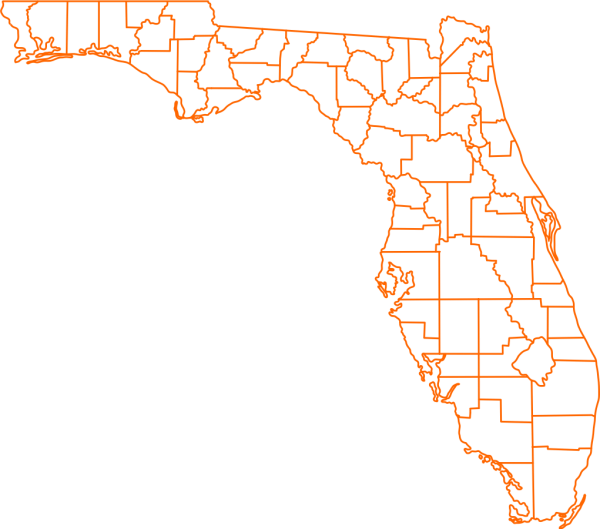

SERVING FLORIDA

If you home or commercial property has been damaged due to natural disasters, hurricane, storm damage, water damage, or fire, we can help get the settlement you deserve. Our independent adjusters will help you with all kinds of claims ranging from roof damage, denied claims, underpaid claims, flooding, broken pipes or plumbing. With locations in, Boca Raton, Fort Lauderdale, Orlando, Fort Myers, and Tallahassee our Public Adjusters across Florida are here to help you from the moment you contact us until your property is restored to its pre-loss condition.

When damage to your home or business requires that you file an insurance claim, don’t face the insurance carrier alone. Contact our public loss adjusters today!

Exceptional Service and Honesty

From Underpaid to Fully Compensated

First and most obvious, they got us more money than we ever expected. We had storm damage after a series of strong (not hurricane) storms ravaged our Cedar SHake roof. We made a claim to the insurance company and they sent us $11,000. It was a joke. Then we got serious and after research employed Bad Dog Adjusters (aka Floridas Best Adjusters). They spent hours here, measuring, calculating and analyzing data. They then submitted a claim to the insurance company for $94,000 – we had no idea that interior damage was covered. The insurance company turned us down. Bad Dog suggested attorney Neil Singh. He went into battle like a ninja, and never let go. It took over a year, but our final cash settlement went to a total of $71,000. We replaced roof and fixed many other issues. Thank you, Sasha and Steve Lippy, and all the rest of the crew at Bad Dog. You are the best.

Outstanding Job!

Walked me through every step of the process. Lived up to their end of the bargain. Extremely professional. Only person who was in my corner looking out for my best interest. When the insurance company ignored my claim they referred an attorney to me that helped get things moving again. After a prolonged process of stonewalling by my insurance company I got paid every penny I was owed. Thank you for all the help.

This company is fantastic!

This company is fantastic from the top to bottom! Communication and thoroughness was so refreshing. The result were amazing. Stephen is the best!!

Stephen is a great resource

Stephen is a great resource for help with everything related to first-party property claims. He is knowledgeable, fair, civil, and reliable. I look forward to many more claims with him and his company. I am writing this review because I couldn’t believe that there is an adjuster who will decline a claim when it’s not good or fair to even make a claim. That’s honesty that is not seen everyday. Talking and deal with Stephen is a real joy. He is a straight shooter and what you see is what you get. A true professional that is generous with his time and knowledge. A gentleman by any other words. Thank you!

I called Stephen for help

I called Stephen for help with a new construction build and a disaster with the flooring. He listened intently to my story and although we could not use his services because there was no claim to make, he helped us immensely in navigating what our options were and spent a considerable amount of time with us. He was so helpful! Not only that, he gave me his phone number and said we could call back any time if we needed more guidance. A committed professional!

Thank You Stephen!

Thank You Stephen ! You did an outstanding job of dealing with our claim and there was no aggravation or stress for us. You handled all of the details promptly and expeditiously. We will keep your name in our phone book for future use should the need arise. We will recommend you highly to our friends and family

OUR FULLY LICENSED PUBLIC ADJUSTERS FIGHT FOR YOU

Get A Fair Settlement For Your Property Damage

Our Florida Public Adjusters defend your rights with the insurance company to ensure the maximum fair market recovery amount.

Our expert public adjusters are here to support Panhandle residents and businesses. When disaster strikes, we’re your trusted partners for insurance claims assistance.

Our public adjusters stand by the Treasure Coast community, offering support for residents and businesses. When calamity strikes, count on us as your reliable allies in navigating the complexities of insurance claims.

Palm Beach County residents and businesses can rely on our experienced public adjusters. In times of crisis, we are your dedicated partners, providing expert assistance in insurance claims to help you recover.

In Miami-Dade County, our expert public adjusters are your go-to team when disaster strikes. We are committed to helping both residents and businesses with insurance claims, ensuring a smooth path to recovery.

Residents and businesses in the Greater Fort Myers Area can trust our seasoned public adjusters. When you face adversity, we’re here to provide steadfast support in managing insurance claims and securing your future.

For those in the Greater Jacksonville Area, our adept public adjusters offer dependable assistance when disaster looms. We are your trusted partners for navigating the intricacies of insurance claims.

Residents and businesses in the Greater Orlando Area can count on our dedicated public adjusters. When the unexpected occurs, we’re here to offer expert guidance in insurance claims, ensuring a smoother recovery process.

In the Greater Tampa Bay Area, our knowledgeable public adjusters are your steadfast allies during times of crisis. We’re committed to helping you with insurance claims, providing essential support to regain stability.

Broward County residents and businesses can rely on our proficient public adjusters. When you’re faced with adversity, we’re here to provide expert guidance in managing insurance claims, ensuring a seamless path to recovery.

Why Choose

Florida’s Best Public Adjusters?

- Zero up-front cost to you for our claims adjuster service… If you don’t get results we don’t get paid

- Average claims data shows policy holders who hired a public adjuster for non-catastrophic claims received 574% more money than those who did not hire a PA. Policy holders who hired a public adjuster for Hurricane related claims received 747% more money

- Our claims adjuster professionals have been helping homeowners get proper settlements for more than three decades.

30+ Years of Experience

Three decades of expertise, guiding you through every claim with unmatched knowledge and precision.

No Up-Front Cost

Up to 747% More Money

Our clients receive 574% more for non-catastrophic claims and 747% more for hurricane-related claims. Maximize your settlement.

We Work For YOU! Not the insurance Company

Public Adjusters are licensed by the State of Florida and are very good at what we do. We understand the industry inside and out. We have the staff to fight the insurance companies. One last thing, did I mention that we work for You not the insurance company? Please give us an opportunity to help take care of your next claim. Call us before you call your insurance company. We work for YOU not the insurance company.

Insurance Companies Do Not Have Your Best Interest At Heart. WE DO!

In the world of insurance claims, it’s essential to remember that insurance companies operate to protect their own bottom line. While they may promise to be there when you need them, their primary objective is to minimize payouts and maximize profits. At Florida’s Best Public Adjusters, we understand the reality of this industry and are dedicated to representing your best interests throughout the claims process.

The Insurance Company Will Send Out Their Adjuster To Adjust Your Claim, But Their Adjuster Works For Them! Not You!

Once your claim gets going, your helpful insurance company or their Independent Adjuster will bring in a Professional Engineer (PE) to swing by your property to determine what caused your claim. But here’s the twist – the PE isn’t working for you, the PE works for, you guessed it, the insurance company. The main mission of the PE hired by your insurance company is to uncover reasons to reject your claim. So, don’t bother asking them or your insurance company for a copy of their report; they won’t hand it over. They call it their “work product.” No worries, though; we’ve got our own team of Professional Engineers ready to professionally write reports for us, if needed.

No Results, No Charge

Did we mention we work for You not the insurance company? We work on a contingency basis. We don’t get paid until we get you results. If you have been denied or underpaid on a prior claim what do you have to lose? Let us reopen the claim.

EXPLORE OUR SERVICES

At Florida’s Best Public Adjusters, we can assist with opening a new claim or reopening a denied one.

Tiles and shingles may be damaged due to buckling, curling, or may even be missing. Water may be seeping through your roof or walls without your knowledge.

Appliances and AC leaks can cause water damage. Your home or business is usually covered under those circumstances. The foundations and structure of homes can be damaged as a result.

Residential and commercial property can fall victim to fire, a small spark can set ablaze a massive structure. Home fires can be dangerous and cause destruction to your garage, floors, windows and doors. Your insurance company typically covers these types of damages.

In the face of disruptions, our team supports your business claims. We work to recover lost profits and cover operational expenses due to unforeseen closures or disasters. Ensure your business resilience with our expert guidance, safeguarding your financial stability.

Sinkholes may appear as a slight depression in a lawn, a leaning tree or fence post. When they occur underneath or around a house or building they can cause cracking of the interior walls, ceilings, floor slabs and tiles.

Mold damage claims are complex, because of the mold exclusions or limitations that are found in most insurance policies.

Hail storms can strike without warning, leaving dents in your roof, cracks in windows, and damage to your home’s exterior. Even small hailstones can weaken shingles or create hidden leaks that worsen over time. Our team can inspect your property, document the damage, and help you file a strong insurance claim to ensure you’re fully protected.

OUR PROCESS

1

CONTACT US

Schedule your free phone claim consultation. Give us a call or send us a message. We are available 24/7.

2

Inspection & Estimate

Our Public Adjusters will do property inspection and gather as much information as possible. The adjuster will create an estimate of damages and determine – whether residential or commercial properties – how much of the owner’s everyday life has been interrupted. This will be used to submit the claim to the insurance company.

3

Settlement Offer

Your insurance company is obligated to make a decision within 90 days. You receive either a settlement offer, or your claim denied. We are by your side, and have your best interest in mind.

4

Negotiation

Our licensed public adjusters are ready to negotiate your settlement on your behalf. We Through appraisals and mediation, we’ve been able to consistently get homeowners more in their settlement.

5

Settlement Payout

This is every property owner’s favorite part of the process, when you get paid the biggest possible settlement. Florida’s Best Public Adjusters is dedicated to getting you the most for your property damage.