FLORIDA’S BEST PUBLIC ADJUSTER TALLAHASSEE

TALLAHASSEE PUBLIC ADJUSTERS

At Florida’s Best Public Adjusters, we know that many homes and businesses in Tallahassee are damaged by storms, broken appliances, and other incidents each day.

When your home or business is damaged, navigating the insurance claims process can be daunting, and you may think that your insurance company will just write you a check for the maximum amount you deserve. This often isn’t the case. Your insurance company is in the business of trying to pay as little for your claim. You can count on a skilled public adjuster in Tallahassee from our team to help fight for your maximum claim payment.

Do you need a Public Adjuster in Tallahassee Florida?

When your property experiences damage, you want to make sure you are getting the best insurance settlement. Our Public Adjusters offer the best professional insurance claim representation to help you recover quickly, especially in handling property insurance claims. We can prepare your documents, speak with your insurance company and take the entire hassle away from you. We are here for you, not the insurance company.

Below are a few reasons why we are the best option for you if you need a public adjuster in Tallahassee FL.

Following damage to your property, our public adjusters can file your claim with your insurance company within 24 hours.

- We will have an inspection scheduled with your insurance company to adjust and review the damage or loss.

- We make sure this meeting is in accordance with your schedule. One of our adjusters will be by your side the entire time.

- We prepare an estimate of damages to present to your insurance company along with any additional documentation.

- Our team includes former insurance company adjusters with extensive experience, giving us an edge in understanding the claims process from the insurer’s perspective.

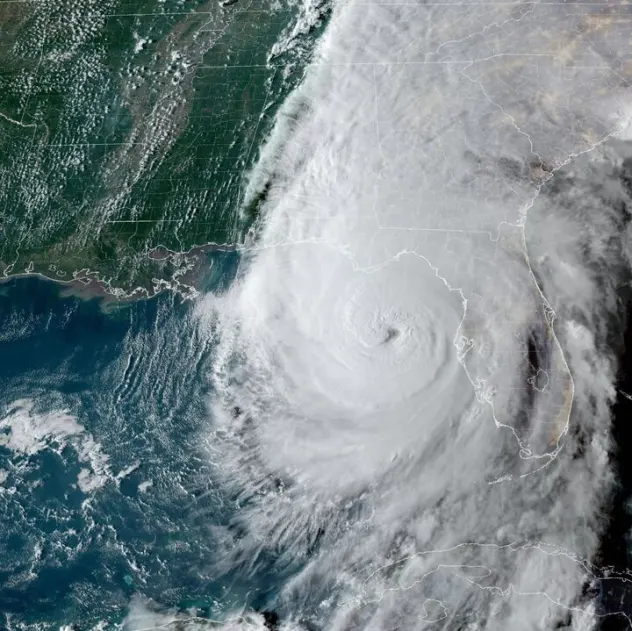

Recently Affected by Hurricane Helene? Here’s How Florida’s Best Public Adjusters Can Help Tallahassee and Neighboring Cities

If you were recently affected by Hurricane Helene in Tallahassee or neighboring cities such as Quincy, Crawfordville, Monticello, and Havana, you’re likely facing the overwhelming task of assessing damage, filing insurance claims, and planning for repairs.

The storm’s powerful winds, flooding, and structural damage can leave you unsure of the next steps. That’s where Florida’s Best Public Adjusters steps in to help you navigate the process and secure the compensation you deserve.

How We Can Help After Hurricane Helene in Tallahassee and Nearby Cities:

Thorough Hurricane & Storm Damage Assessment

After a major storm like Hurricane Helene, it’s essential to have a complete inspection of your property. Our expert public adjusters will assess both visible and hidden damage to homes and businesses in Tallahassee, Quincy, Crawfordville, Monticello, and Havana. We document everything from roof damage to water intrusion and structural issues to ensure your insurance claim covers all damage.

Comprehensive Claim Preparation and Filing

Filing an insurance claim can be daunting, especially after a hurricane. Our team handles the entire process, preparing all necessary documentation, photos, and detailed estimates to ensure your claim is properly submitted. Whether you’re in Tallahassee or nearby cities like Crawfordville or Quincy, we ensure your claim is comprehensive and accurate.

Handling Denied or Underpaid Claims

If your claim has been denied or underpaid, Florida’s Best Public Adjusters is here to help. We specialize in reopening and renegotiating claims to ensure that homeowners and business owners in Tallahassee, Monticello, and other nearby cities get the full compensation they deserve.

Expert Negotiation with Insurance Companies

Insurance companies often try to minimize payouts, but our skilled public adjusters handle all negotiations for you. We advocate on behalf of clients in Tallahassee, Havana, and other nearby areas to ensure you receive a fair settlement that covers all of your damages.

Maximizing Your Settlement

We thoroughly understand insurance policies and will make sure no area of coverage is overlooked. Our goal is to secure the maximum settlement for homeowners and business owners in Tallahassee, Quincy, Crawfordville, and surrounding cities affected by Hurricane Helene.

Why Choose Florida’s Best Public Adjusters in Tallahassee?

We work exclusively for you, the policyholder, and never for the insurance companies. Our goal is to help residents of Tallahassee and nearby cities like Quincy, Monticello, Crawfordville, and Havana recover from Hurricane Helene by maximizing your insurance payout. With our “No results, no charges” policy, you only pay us if we successfully recover compensation for you.

Don’t Wait—Contact Us Today

If your home or business in Tallahassee, Quincy, Crawfordville, Monticello, or Havana has been affected by Hurricane Helene, don’t go through the insurance process alone. Let Florida’s Best Public Adjusters handle your claim, ensuring you get the compensation needed to rebuild. Contact us today for a free consultation, and let us guide you through the entire claims process.

What are the top property damage claims in Tallahassee?

Roof Damage or Leak

Roof Damage can be caused by several factors. For example, poor maintenance can cause a minor damage to become a major problem. Strong winds can severely damage a poorly maintained roof. Make sure to check that the tiles are securely attached.

Hurricane Damage

We offer a no upfront cost consultation to answer all your hurricane damage claims related questions. Insurance companies have a team of professional insurance adjusters representing their interest in the claims process, you deserve the same representation.

FLORIDA'S BEST PUBLIC ADJUSTERS - TALLAHASSEE

PROFESSIONAL CLAIM REPRESENTATION

NO RESULTS, NO CHARGE!

Florida’s Best Public Adjusting Services can help with numerous home damages such as Water Damage, Roof Leaks, Hurricane, Flood, Smoke & Fire, Mold, Business Interruptions and more.

Our team at Florida’s Best Public Adjusters Tallahassee can help with a wide range of claims. Hurricane damage, water damage, storm damage, fire damage, sinkholes, and roof leaks are just a few of the damages our team at Florida’s Best Public Adjusters can help address. If you’re looking for the best help with your insurance claim, give our team a call.

You can schedule your free consultation and damage inspection with a skilled public adjuster in Tallahassee by calling our team at (850) 807 – 0123. We’re here to help with your claims, call today!

Storm Damage

Florida residents are no strangers to tropical storms and hurricanes that can devastate your property. However, insurance carriers have modified their policies without a full explanation of what changes have taken place and how it affects your coverage. Our adjusters understand your policy and can translate whether it only provides coverage for damage due to wind or also damage from torrential rain, flooding or storm surge

Roof Damage

Roof Damage from Hail and Wind is handled differently than hurricane claims when it occurs in the absence of a “named” storm. Damage from Hail and Wind damage occurring outside of a “named” storm are covered under your standard insurance policy a great deal of the time. Hail/wind damage are not easy to prove. I will fight for the maximum amounts permitted under your homeowner or commercial business policy.

Water Damage

Sometimes a small leak can turn into a major headache and your insurance policy may or may not cover the leak depending on its source. The public adjusters at Florida’s Best Public Adjusters are property damage experts with years of experience handling water damage issues regardless of the source.

Mold Damage

Mold resulting from flooding, a broken pipe or other water-related issue can severely affect your health and property without your knowledge. Here in Florida’s warm, humid climate mold is particularly aggressive causing a variety of serious health issues. It is also your property’s potential enemy since it can weaken the building’s structure much as termites do.

Smoke & Fire Damage

Even a small, accidental kitchen fire can cause a big headache. Perhaps it’s a lightning strike, a careless cigarette or an encroaching wildfire. Dealing with city and county officials, your insurance company and the fire department is stressful and time-consuming. After evaluating the damage caused by flame, smoke and water, your public adjuster will review your insurance policy to determine coverage.

Sinkholes

Sinkholes can cause extensive property damage depending on their size and depth. Some swallow entire buildings; others leave a house or commercial property heavily damaged or uninhabitable. In many cases, your insurance carrier will send a professional engineering team (that work for the insurance company) to drill into the ground and analyze the soil composition to determine whether there has been sinkhole activity. As your representative, we secure the same reports from an objective provider.

Business Interruption

In the event that a disaster should impact your business, it may result in your place of work becoming unusable. Losses can be from fire, smoke, water damage, mechanical breakage of large machinery, hurricane, storm or wind damage, etc. Income will not be produced while fixed costs may continue to incur (e.g. rent, utilities, etc.)

During this period of business interruption, whatever income your business would have made cannot be used. Our forensic specialists analyze your historic financial records to determine this unusable income and work hard to speed up the process which gets you paid quickly.

Dropped or Fallen Objects

Face it, we are all clumsy. Some accidents happen without human interaction. Heavy wall mounted objects of art fall and damage walls, floors and furniture. These falling or dropped object claims are valid and are generally able to be submitted as claims subject to your policy deductible.

In Florida the statute is to repair or replace with matching material. If your finishes are older it may be impossible to repair one area so that it matches. In that case your insurance company may be persuaded by Florida’s Best Public Adjusters to provide for the replacement of the entire floor, counter, patio tile, etc. that was a result of sudden and accidental damage to your property from a dropped or falling object.!

What is a Public Adjuster and How Can They Help With My Insurance Claim?

A public adjuster is a professional insurance claim representative who works exclusively for policyholders, not the insurance company. Their primary role is to assist policyholders in navigating the complex claims process, ensuring you receive a fair and accurate settlement for your insurance claim. Public adjusters are licensed and experienced professionals who have a deep understanding of insurance policies, regulations, and the claims process. We work on behalf of the policyholder to negotiate with the insurance company, gather evidence, and prepare and submit claims.

Benefits of Hiring a Public Adjuster

Reasons to Hire a Public Adjuster

Working with a public adjuster can have many benefits for policyholders. Here are some of the reasons to hire a public adjuster:

- Professional Claim Representation: Public adjusters know the insurance claim process inside and out so policyholders get the most money you are entitled to.

- No Out of Pocket Costs: Public adjusters work on a contingency basis so we only get paid if we win the claim. No upfront costs for policyholders.

- Expert in Complex Claims Process: Public adjusters are well versed in the complex claims process and can navigate it quickly so policyholders get a fair and accurate settlement.

- Higher Settlements: Public adjusters can get higher settlements than policyholders could on their own because we know the insurance policies and regulations.

- Less Stress: Public adjusters handle all communication with the insurance company so policyholders have less stress and hassle.

The Claim Process

What to Expect

The claim process can be confusing for policyholders. Here’s a step by step guide:

- Filing a Claim: Policyholders notify their insurance company of a loss or damage and the insurance company assigns an adjuster to the file.

- Inspection and Evaluation: The adjuster inspects the damage and evaluates the loss.

- Claim Submission: The policyholder or public adjuster submits the claim to the insurance company.

- Negotiation: The insurance company reviews the claim and may negotiate with the policyholder or public adjuster to reach a settlement.

- Settlement: The insurance company offers a settlement and the policyholder can accept or decline.

- Appeal: If the policyholder is not happy with the settlement we can appeal.

Keep in mind the process may vary with different types of insurance and claims.

It’s important to note that the insurance claim process can vary depending on the type of insurance and the specific circumstances of the claim. A public adjuster can help policyholders navigate this process and ensure you’ll receive a fair and accurate settlement.

REQUEST YOUR

Our Public Adjusters

NOT the insurance company.

When damage to your home or business requires that you file an insurance claim, don’t face the insurance carrier alone. Don’t settle for what the insurance company thinks you deserve. Insurance companies typically offer an initial settlement that is only a fraction of your claim value. Contact the best Tallahassee Public Adjusters today!