Hurricane Helene: What to Expect and How Florida’s Best Public Adjusters Can Help You in the Big Bend

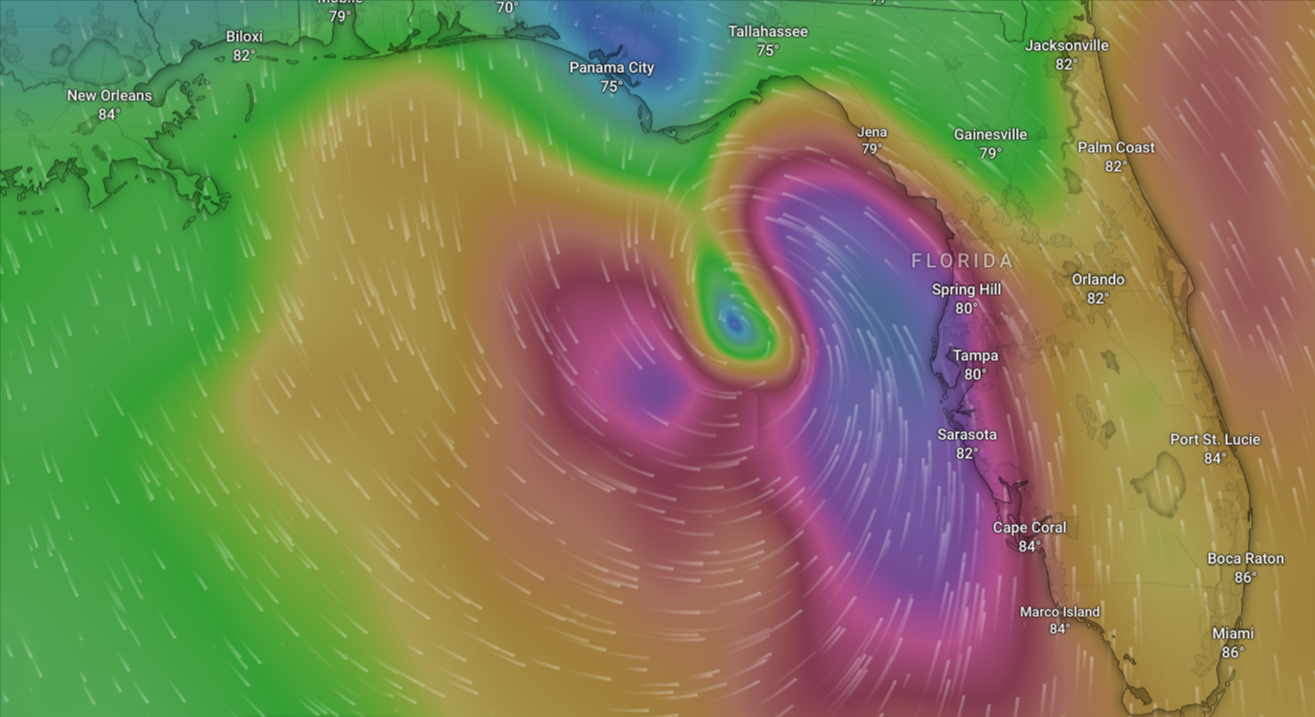

As Hurricane Helene hits Florida’s Big Bend, residents are getting ready for another big one. The Big Bend area is known for its quirky coastline and storm surge vulnerability. With Helene bringing heavy rain, strong winds, and possible flooding, homeowners and business owners between Tallahassee and Gainesville need to be prepared for the damage.

Hurricanes leave behind a trail of destruction and the insurance claims process is overwhelming. That’s where Florida’s Best Public Adjusters comes in. Our team of licensed public adjusters will help you get back on your feet after Hurricane Helene by getting your insurance claim processed and getting you the most money you’re owed.

Hurricane Helene and the Big Bend

The Big Bend area is uniquely located where the Florida panhandle meets the peninsula and is very susceptible to storm surges and flooding. With Helene coming, experts are saying the storm could bring 100 mph+ winds and heavy rain. These conditions can cause not only immediate damage but also secondary issues like water damage, mold growth and structural problems.

After a hurricane, residents often face extensive damage to homes, businesses and other properties. From roof damage from high winds to flooding that ruins interiors and foundations, the list of potential damage is long. Insurance claims can get complicated fast especially when dealing with multiple types of damage. That’s where having a public adjuster on your side can make all the difference.

Hurricane Helene and Wind Damage

Hurricane Helene is projected to impact areas far beyond the immediate cone of uncertainty due to its expansive size. Wind damage is anticipated as far east as Orlando, while Tampa, known for its vulnerability to flooding, is expected to experience substantial damage from heavy rains and rising waters. Helene’s wide-reaching effects mean that even regions outside the direct path will face severe weather conditions, including strong winds and potential flooding.

How Florida’s Best Public Adjusters Can Help

When disaster strikes, it’s crucial to have an expert on your side who understands the insurance claims process and knows how to advocate for your best interests. Florida’s Best Public Adjusters works exclusively for policyholders—not the insurance companies. Our goal is to help you maximize your claim and reduce the stress of navigating the complicated insurance landscape. Florida’s Best Public adjusters have office locations and insurance adjusters all across the state of Florida. We proudly serve our clients through storm damage, smoke damage, fire damage, roof leaks, business interruptions and more.

Here’s how Public Adjusters can help residents in the Big Bend after Hurricane Helene:

- Damage Assessment: Our team will conduct a thorough inspection of your property to assess all damages, including those that may not be immediately visible, such as hidden water damage or structural issues. Insurance company adjusters may overlook or undervalue certain damages, but we ensure that every aspect is documented for your claim.

- Comprehensive Documentation: Proper documentation is key to a successful insurance claim. We will provide detailed reports, photographs, and estimates to substantiate your claim, ensuring that you have the evidence needed to receive the full compensation you deserve.

- Negotiating with Insurance Companies: Insurance companies often aim to minimize payouts, offering settlements that may not cover the full extent of your losses. As experienced negotiators, we will handle all communications with your insurance provider, pushing back against lowball offers and fighting for a fair settlement on your behalf.

- Maximizing Your Settlement: We understand the intricacies of insurance policies and how to navigate them to your benefit. Our expertise allows us to identify all areas of coverage that may apply to your claim, ensuring that you receive the maximum settlement possible.

- Saving You Time and Reducing Stress: Filing an insurance claim after a hurricane can be time-consuming and stressful, especially when you’re already dealing with the emotional and physical toll of property damage. By letting Florida’s Best Public Adjusters handle your claim, you can focus on rebuilding your life while we take care of the paperwork and negotiations.

Hurricane Helene Preparation

As you prepare for Hurricane Helene make sure to secure your property as much as possible by boarding up windows, moving valuable items to higher ground, and review your insurance policy. If you sustain damage after the storm don’t hesitate to contact Florida’s Best Public Adjusters. Our motto is simple “No results, no charges” which means we only get paid if we recover for you.

In summary, Hurricane Helene will bring big challenges to the Big Bend area but with Florida’s Best Public Adjusters by your side you can rest assured you will have expert help in navigating the insurance claims process and getting the most out of your settlement. Whether your home or business suffers wind or storm damage we can help you get back on your feet. Contact us today for a free consultation and let us guide you through the process.

Contact The #1 Public Adjusters In Florida Following Hurricane Helene

As Hurricane Helene bears down on Florida, the potential for widespread damage is significant, impacting cities like Tallahassee, Gainesville, Orlando, and Tampa. If your home or business sustains damage from wind, navigating the insurance claims process can be overwhelming. Florida’s Best Public Adjusters is here to advocate on your behalf, ensuring you receive the maximum compensation you deserve. We handle everything from assessing the full extent of the damage to negotiating with insurance companies, allowing you to focus on recovery. Don’t leave your settlement to chance—contact Florida’s Best Public Adjusters today for expert help in managing your hurricane damage claims and restoring your property.

If you are in need of a public adjuster in tampa or a public adjuster in Orlando we can help!

Photo Information: The image is a screenshot from Windy.com

Florida’s Best Public Adjusters Orlando

Secondary phone: (800) 952-7693

Email: info@flbestpublicadjusters.com

Florida’s Best Tampa Public Adjusters

Secondary phone: (800) 952-7693

Email: info@flbestpublicadjusters.com