#1 Public Adjuster in Tampa

When your home or business suffers damage, navigating the insurance claims process can be overwhelming, especially if you’re unsure how to proceed or if your insurer isn’t offering a fair settlement. This is where a Tampa public adjuster can make all the difference. At Florida’s Best Public Adjusters, we are committed to helping our clients get the maximum compensation they deserve for their claims. Whether it’s for a residential or commercial property, our team is here to guide you every step of the way.

We understand the challenges of dealing with insurance companies, who often prioritize their bottom line. This can leave homeowners and businesses in Tampa with underpaid or even denied claims. But with our experienced Tampa public adjusters, you don’t have to navigate this complex process alone.

What Kinds Of Claims Can A Public Adjuster In Tampa Help With?

A Public Adjuster Can Help You:

At Florida’s Best Public Adjusters, we work with a wide range of insurance claims for homeowners and business owners in Tampa. In fact, our public adjusters can help with many different claims, fighting for top settlements for our clients. Ultimately, our number one goal is to help each client get the maximum settlement for their home or business insurance claims.

Moreover, at Florida’s Best Public Adjusters, we don’t get paid unless you get paid. Therefore, hiring our public adjusters can make all the difference in your claims process! So, don’t let your insurance company give you anything less than what you deserve. Schedule your free consultation and inspection with our public adjusters today!

For immediate assistance, please call (813) 895-3149 right now and get started!

The Benefits of Working with a Public Adjuster in Tampa

You may ask, “Do I need a public adjuster in Tampa?” The answer is quite simple: yes, if you want to avoid some common pitfalls that may characterize an insurance claim process. Our Tampa public insurance adjusters act as advocates for policyholders, managing all aspects of your insurance claim to ensure you receive the maximum payout. Here’s what we do:

- Evaluating your insurance policy: We thoroughly review your coverage to ensure you understand your rights.

- Documenting damages: We conduct a complete assessment of all damages, repair costs, and additional expenses related to your claim.

- Communicating with your insurer: We handle all communication with your insurance company to make the process smoother.

- Negotiating on your behalf: Our expertise in negotiating ensures you receive the highest possible settlement.

Whether you’re dealing with hurricane damage, water damage, or a business interruption claim, our Tampa property damage public adjusters have the knowledge and experience to handle any claim. We pride ourselves on providing personalized service, giving our clients peace of mind during a stressful time.

Without the representation of a public adjuster, your claim might get settled at a low value or even get denied. Here is why it pays to work with Florida’s Best Public Adjusters:

Professional Representation: We are cognizant of the intricacies that may arise with an insurance policy and thus assist you in navigating these complex claim situations to avoid being short-changed.

No Upfront Costs: We operate on a contingency fee basis, which means you don’t pay unless we settle your claim.

Smarter Claims Resolution: We hasten the claims process so that you can have your payout in no time.

Correct Damage Assessment: Our specialists take a close look at your property to ensure that no damage goes unnoticed.

With over a thousand processed claims, serving both homes and businesses in distress, we are one of the highest-rated public adjusters in Tampa. We will be your trusted partner in bringing a favorable outcome for your insurance claim.

Types of Claims Our Tampa Public Adjusters Handle

In our service, our team is specialized in all kinds of insurance claims to make sure your rights for fair compensation are taken care of, whatever the situation may be:

Hurricane Claims: The area around Tampa is often hit by hurricanes, and hence we have comprehensive experience in handling hurricane insurance claims with the idea of maximizing their settlements.

Water damage claims range from burst pipes to floods. Our Tampa water damage public adjusters ensure you receive the compensation required for full repairs.

Fire and smoke damage claims: Fire damages are the most devastating, and we help recover every dollar one needs for restoration. Roof damage claims are well within our expertise, as our adjusters have handled roof damage claims due to roof leaks and storm damage.

Business Interruption Claims: We also handle claims for loss of income due to property damage, so we can get the businesses of Tampa running again.

Claim Denials or Underpayment: In cases of a denial or underpayment, we have a staff of denied insurance claim public adjusters that fight for the rights of people just like you and seek the overturning of unfavorable decisions.

FLORIDA'S BEST PUBLIC ADJUSTERS - TAMPA

PROFESSIONAL CLAIM REPRESENTATION

NO RESULTS, NO CHARGE!

Florida’s Best Public Adjusting Services can help with numerous home damages such as Water Damage, Roof Leaks, Hurricane, Flood, Smoke & Fire, Mold, Business Interruptions and more.

At Florida’s Best Public Adjusters, no damage is too big or small for our services. Our public adjusters can work to ensure that you receive the proper settlement for your insurance claim so your damages can be fully repaired at no upfront cost to you.

Our adjusters work for you, not for the insurance company.

Storm Damage

Tampa is no stranger to tropical storms and hurricanes that can destroy your property. Yet, over time, insurance carriers have altered their policies without thoroughly explaining what changed and how that impacts your coverage. Our Tampa Bay Public adjusters understand your policy and can translate for you whether it covers damage due only to wind or also damage due to torrential rain, flooding, roof damage or storm surge.

Don’t face the challenges of navigating your insurance claim alone—our team is here to help you every step of the way.

Tampa Roof Damage Claim

Damage from hail and wind is considered differently than damage from a hurricane when it occurs outside of a “named” storm. More often than not, hail and wind damage that occurs outside of a named storm is covered under your standard homeowner or commercial insurance policy. Proving damage from hail and wind does prove to be difficult most of the time, since it requires very specific evidence and specialized experience.

I will stop at nothing to make sure that, as your public adjuster in Tampa, you are getting the most out of what is provided by your policy for either your residential or commercial property. Let me handle the details in your claim to ensure you get a rightfully owed payout.

Water Damage

Mold Damage

Water damage from flooding, burst pipes, and other similar incidents can lead to mold growth that can harm your health and property without you even realizing it. Due to Tampa’s warm and humid climate, mold grows very fast, creating serious health concerns, such as allergies and respiratory issues. Besides health risks, mold can also compromise the structural integrity of your property, just like termite infestation. Our Tampa public adjusters are here at Florida’s Best Public Adjusters to guide you through your mold damage claim and see you through getting compensated right for the restoration of your property.

Smoke & Fire Damage

Even a small, accidental kitchen fire can cause a big headache. Perhaps it’s a lightning strike, a careless cigarette or an encroaching wildfire. Dealing with city and county officials, your insurance company and the fire department is stressful and time-consuming. After evaluating the damage caused by flame, smoke and water, your public adjuster will review your insurance policy to determine coverage.

Sinkholes

Sinkholes can cause extensive property damage depending on their size and depth. Some swallow entire buildings; others leave a house or commercial property heavily damaged or uninhabitable. In many cases, your insurance carrier will send a professional engineering team (that work for the insurance company) to drill into the ground and analyze the soil composition to determine whether there has been sinkhole activity. As your representative, we secure the same reports from an objective provider.

Business Interruption

In the event that a disaster should impact your business, it may result in your place of work becoming unusable. Losses can be from fire, smoke, water damage, mechanical breakage of large machinery, hurricane, storm or wind damage, etc. Income will not be produced while fixed costs may continue to incur (e.g. rent, utilities, etc.)

During this period of business interruption, whatever income your business would have made cannot be used. Our forensic specialists analyze your historic financial records to determine this unusable income and work hard to speed up the process which gets you paid quickly.

Dropped or Fallen Objects

Face it, we are all clumsy. Some accidents happen without human interaction. Heavy wall mounted objects of art fall and damage walls, floors and furniture. These falling or dropped object claims are valid and are generally able to be submitted as claims subject to your policy deductible.

In Florida the statute is to repair or replace with matching material. If your finishes are older it may be impossible to repair one area so that it matches. In that case your insurance company may be persuaded by Florida’s Best Public Adjusters to provide for the replacement of the entire floor, counter, patio tile, etc. that was a result of sudden and accidental damage to your property from a dropped or falling object.!

How to Hire a Public Adjuster in Tampa

Hiring a Tampa public adjuster is simple and risk-free. We offer free consultations and operate on a no win, no fee basis, meaning there’s no financial risk to you. Whether you’re dealing with a new claim or need help with an existing one, our team is ready to assist. Public adjusters near Downtown Tampa, South Tampa, and Westshore can help you navigate your insurance claim efficiently.

Why Choose Florida’s Best Public Adjusters?

- Top public adjuster companies in Tampa: We’ve earned our reputation by consistently delivering results for our clients. Just check out our Florida’s Best Public Adjusters reviews in Tampa.

- Affordable public adjuster Tampa: We provide top-tier service with no upfront costs.

- Public adjuster services for residential and commercial claims: Whether you’re a homeowner or business owner, we offer specialized services to meet your needs.

Frequently Asked Questions

How can a Tampa public adjuster help me?

A public adjuster ensures that your claim is properly filed and managed, preventing delays and maximizing your settlement.

What does a public adjuster do in Tampa?

We assess the damage, communicate with your insurer, and negotiate the best possible settlement on your behalf.

How to dispute an insurance claim in Tampa?

If your claim is denied or underpaid, we’ll help you gather the necessary documentation and fight for the payout you deserve.

What to do if your insurance claim is denied in Tampa?

Contact us immediately! We specialize in handling denied claims and will work to overturn the decision.

What Kinds Of Claims Can A Public Adjuster In Tampa Help With?

How Florida’s Top Public Adjusters Can Help After Hurricane Milton in Tampa

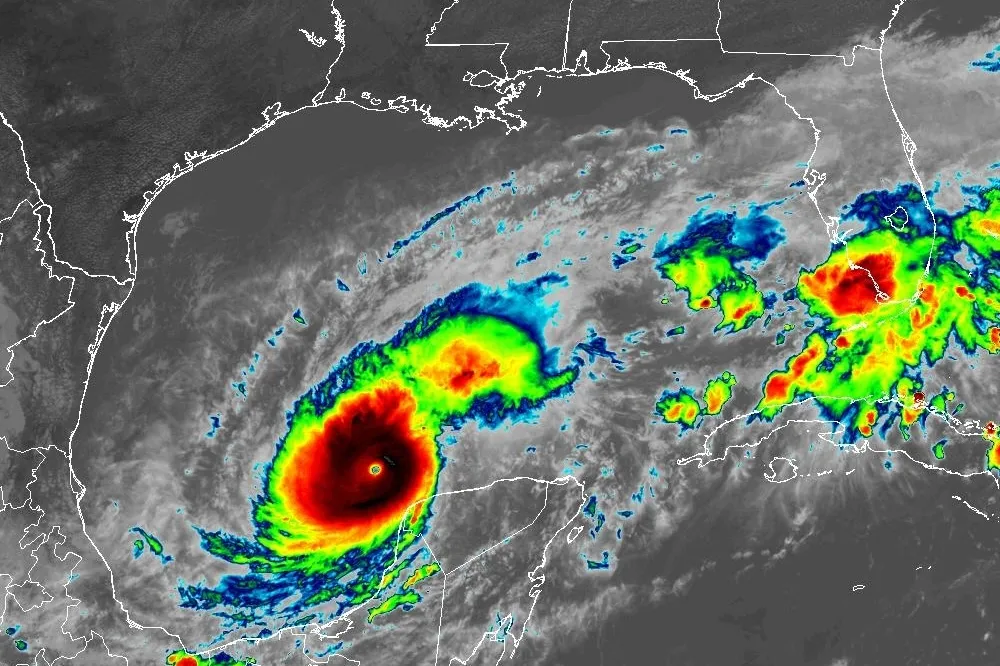

Hurricane Milton has hit Tampa and left a path of destruction behind, leaving homeowners and businesses dealing with the aftermath of major property damage. The storm’s high winds, flooding and heavy rain have caused structural damage, roof damage and even water intrusion in many homes and businesses. Filing a Hurricane Milton insurance claim in Tampa can be a nightmare and when insurance companies are not paying fairly. That’s where Florida’s Top Public Adjusters come in to help.

As a top Tampa public adjuster we know how to navigate the hurricane claims process. Our goal is to get you the maximum amount of money to get your home or business back to pre-storm condition.

Full Property Damage Inspections for Hurricane Milton

Hurricane damage goes beyond what you can see. With Hurricane Milton many Tampa homes and businesses are dealing with roof damage, structural issues and water intrusion that may not be visible. Our public adjusters do a full property inspection to document all the damage – seen and unseen. This way your Hurricane Milton insurance claim will cover the full extent of the damage including long term risks like mold growth, foundation issues and compromised roofing systems.

When you work with Florida’s Top Public Adjusters you have a team working for you to make sure every aspect of the damage is covered in your insurance claim.

Simplified Hurricane Milton Claims Process

Filing a Hurricane Milton insurance claim in Tampa can be a nightmare especially when insurance companies are trying to low ball you. Our team at Florida’s Top Public Adjusters will walk you through every step of the process. From documenting damage and estimating repair costs to negotiating with your insurance company we will make sure your claim is handled smoothly and you get what you deserve.

We have been handling hurricane damage claims for years and know the tactics insurance companies use to delay or underpay claims. We will push back on low offers and make sure your Hurricane Milton claim reflects the full extent of your losses.

Help with Denied or Underpaid Hurricane Milton Claims

If your Hurricane Milton insurance claim has been denied or underpaid don’t give up. Insurance companies often reduce payouts after a big storm like Hurricane Milton. As a public adjuster in Tampa we specialize in reopening and negotiating underpaid or denied claims. Our results show we can get you a fair settlement even after a claim is denied.

When you choose Florida’s Top Public Adjusters, you can rest assured that we will fight tirelessly for what you are entitled to and, most importantly, make sure all hurricane-related damage is covered and paid for.

Why Choose Florida’s Top Public Adjusters After Hurricane Milton?

- Hurricane Damage Experts: We handle hurricane claims including Hurricane Milton claims.

- No Upfront Fees: We work on a contingency basis so you don’t pay unless we get you money.

- Full Service: From full damage assessment to claim negotiations we do it all for you.

- Faster Claim Process: We expedite your claim so you can get repairs started as soon as possible.

Call Us for Your Hurricane Milton Insurance Claim

Don’t go through the insurance claims process alone. Let Florida’s Top Public Adjusters handle your claim from start to finish and get you the maximum settlement to get you back.

Call today for a free consultation to discuss your Hurricane Milton insurance claim in Tampa. We will help you get what you need to get your home or business back.

No Upfront Costs for Tampa Claims

We operate on a contingency fee basis, so you don’t pay unless we recover funds for you.

In any case, whether you’re dealing with storm damage, flood damage, or underpaid claims in Tampa, our team works tirelessly to get you the maximum settlement.

If you’re ready to start, call Florida’s Best Public Adjusters at (813) 895-3149 for a free consultation today. Not only do we handle the claims process for you, but we also ensure you receive the compensation you deserve.

Additionally, whether you’re dealing with storm damage, roof leaks, or business interruptions, our Tampa public adjusters are here to help you secure the settlement you deserve.

Contact Florida’s Best Public Adjusters in Tampa Today

Don’t let an underpaid or denied claim leave you in financial distress. Contact Florida’s Best Public Adjusters for expert representation and a free consultation. With our experienced team by your side, you can navigate the insurance claims process with confidence and achieve the best possible outcome for your property in Tampa.

Get the Best Settlement with a Tampa Public Adjuster

When disaster strikes, indeed, don’t settle for less than you deserve. Instead, let the professional Tampa public adjusters at Florida’s Best Public Adjusters handle your claim from start to finish. Whether you’re dealing with storm damage, flood damage, or underpaid claims in Tampa, our team works tirelessly to get you the maximum settlement.

Ready to start? Call Florida’s Best Public Adjusters at (813) 895-3149 for a free consultation today. We handle the claims process for you and ensure you receive the compensation you deserve.

With Florida’s Best Public Adjusters by your side, you can trust that your insurance claim is in expert hands. Call now and get the settlement you deserve!