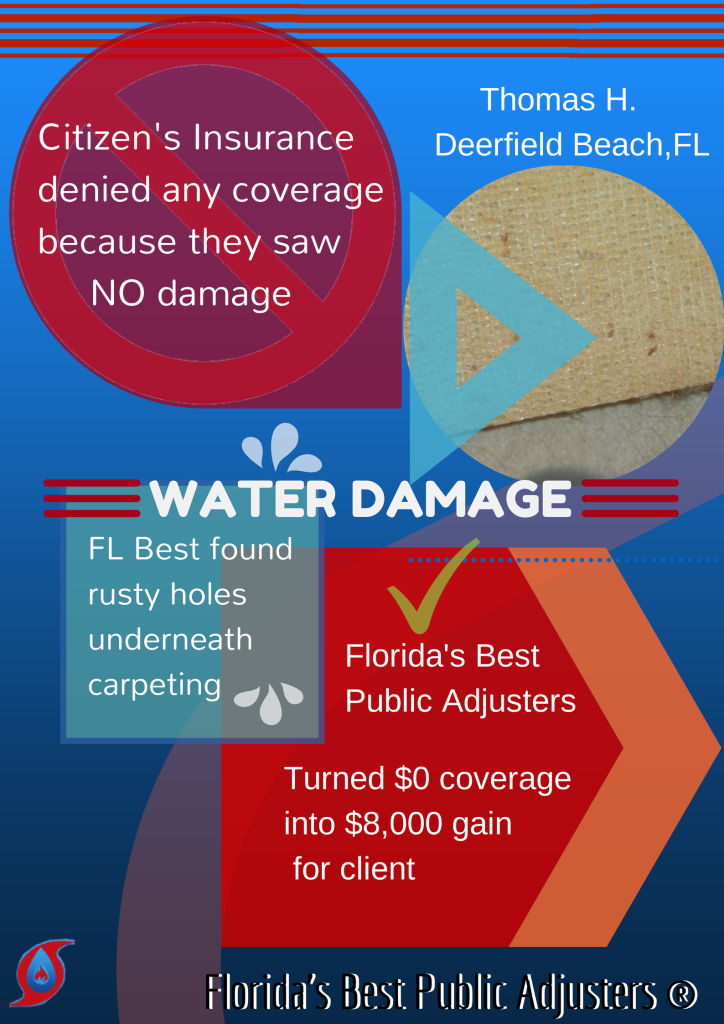

After submitting evidence of the rusty nail holes we detected on our client’s carpeting to the insurance carrier, our clients were able to receive $8,000 worth of coverage.

How FL Best can help

Citizen’s Insurance denied our client Thomas H. from Deerfield Beach, FL any coverage because there was no evidence of damage to his home. FL Best discovered rusty holes in the carpeting beneath the carpeting. Florida’s Best Public Adjusters turned a client’s $0 insurance coverage into a $8,000 profit.

What insurance can I claim for water damage?

Water leaks and water damage are only covered by homeowners insurance if the cause is abrupt or unintentional. For example, if a pipe bursts out of nowhere, your insurance coverage will most likely cover the damage. Homeowners insurance does not cover water damage that happens gradually and over time.

How do I deal with insurance after water damage?

Any water damage claim should be reported to your agent or company representative right once. They can talk about the types of water or mold damage that your policy could cover. At FL Best We will try to help you get what you deserve from your policy.

What should you not say to an insurance adjuster?

Dealing with an Insurance Adjuster: What Not to Say

- Understand the responsibilities of an insurance adjuster before speaking with one.

- Don’t go into too much detail regarding the accident or your property damage.

- Don’t go into too much information regarding the injury.

- Do not sign anything or make a comment that will be recorded.