Almost 30% of all claims for Hurricane Irma are being denied by the insurance company. If you claim was denied, please call us as we can help you and make sure you receive a fair settlement.

On September 2017 Hurricane Irma touched Florida shores. It has been more than four months since the powerful storm caused catastrophic damage to the area and many homes and businesses are still on the road to recovery. In order to assess the damage, The Office of Insurance Regulations collects claims and other relevant information from insurance companies. These figures are intended to inform the general public about the impact of a catastrophic event on Florida’s Insurance Industry.

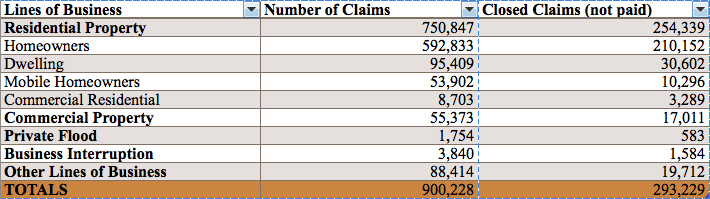

According to the Florida Office of Insurance Regulation, the total estimated insured losses for the 2017 Hurricane Irma is close to 8 billion dollars with the majority of the claims filed in Dade, Broward, Orange, Collier and Lee County. The latest report released on February 9th, 2018, states the number of claims statewide totals 900,228. This figure is broken up as follows:

These figures show that about ⅓ of all claims for Hurricane Irma was denied by the insurance company. If this has happened to you, if you claim was denied, please call us as we can help you and make sure you receive a fair settlement.

A total number of claims, 32.5% are unpaid and 14.1% still remain open.

While most of the claims are closed, a high percentage of the claims where unpaid. Therefore, there are many home and business owners that would benefit from professional claim representation. At Florida’s Best Public Adjusters we can help by reopening a closed, denied or underpaid insurance claims when the insured feels they have not received a fair compensation.

How can a Public Adjuster help you when you claim was denied or underpaid?

If you filed a homeowners insurance claim and feel your insurance company has underpaid you or denied your claim, you aren’t helpless. At Florida’s Best Public Adjuster, we will walk you through the process to dispute a claim offer or claim denial, and help make sure your settlement is fair. Also, any evidence that you gather to support damages, financial loss and cost of repairs will help. Our Public Adjusters service the entire state of Florida and have helped many clients obtain the compensation they deserve.

In addition, according to the Florida Legislature’s Office of Program Policy Analysis and Government Accountability, policyholders who hired a Florida public adjuster received more than five times more money than those who did not hire a public adjuster. Average claims data shows policyholders who hired a public adjuster for non-catastrophic claims received 574% more money than those who did not hire a Public Adjuster. Policyholders who hired a public adjuster for Hurricane related claims received 747% more money. Florida’s Best Public Adjusters has a staff of professional adjusters who will take care of your claims needs to your satisfaction.

We proudly serve the entire state of Florida and our offices are located in Boca Raton, Fort Lauderdale, Fort Myers and Orlando FL. Our Public Adjusters can a provides professional insurance claim representation for the following types of loses: Water Damage, Roof Leaks, Hurricane, Flood, Smoke & Fire, Mold, Business Interruptions and more.

Call us at (800) 952 – 7693 or visit our website www.flbestpa.com to find out more. In addition, you can also retain our services by completing the claim registration contact form.

4 easy steps to Post Hurricane Insurance Claims

-

Step 1: Call a Public Adjuster

Our licensed public adjusters can help you get a fair compensation.

-

Step 2: Document Everything

Keep track of repair estimates, damage photographs, and video.

-

Step 3: Don’t take NO for an Answer

Insurance companies often deny claims. We are here to fight for you!

-

Step 4: Get the fair compensation you deserve.

Let our Public Adjuster work for you and get you paid the most for your claims.

Updates: It is important to state that the total number of insurance claims in the state of Florida due to Hurricane Irma is still changing. The state department of insurance is due to release another report with the latest figures on April 9th, 2018. For more information visit: www.floir.com