Case Study $90,000: Water Damage Claim Fort Lauderdale

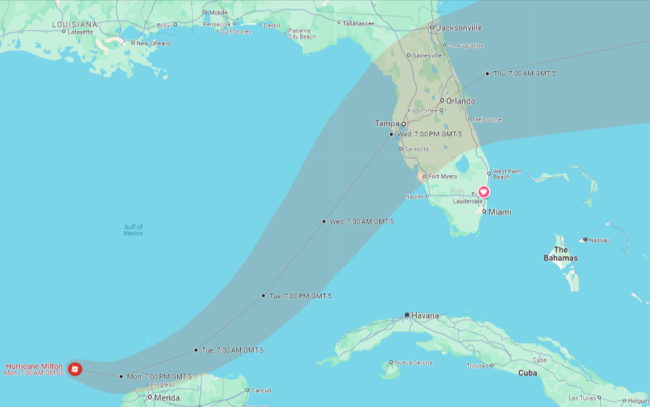

*Picture For Reference Only – We Value the Privacy of Our Client Case Study: Water Damage Claim Fort Lauderdale – How Did We Get Maria L. a $90,000 Settlement? Maria L. submitted a Water Damage Claim to her insurance company after excessive rain damaged her property, along with many others in Fort Lauderdale. Her house…