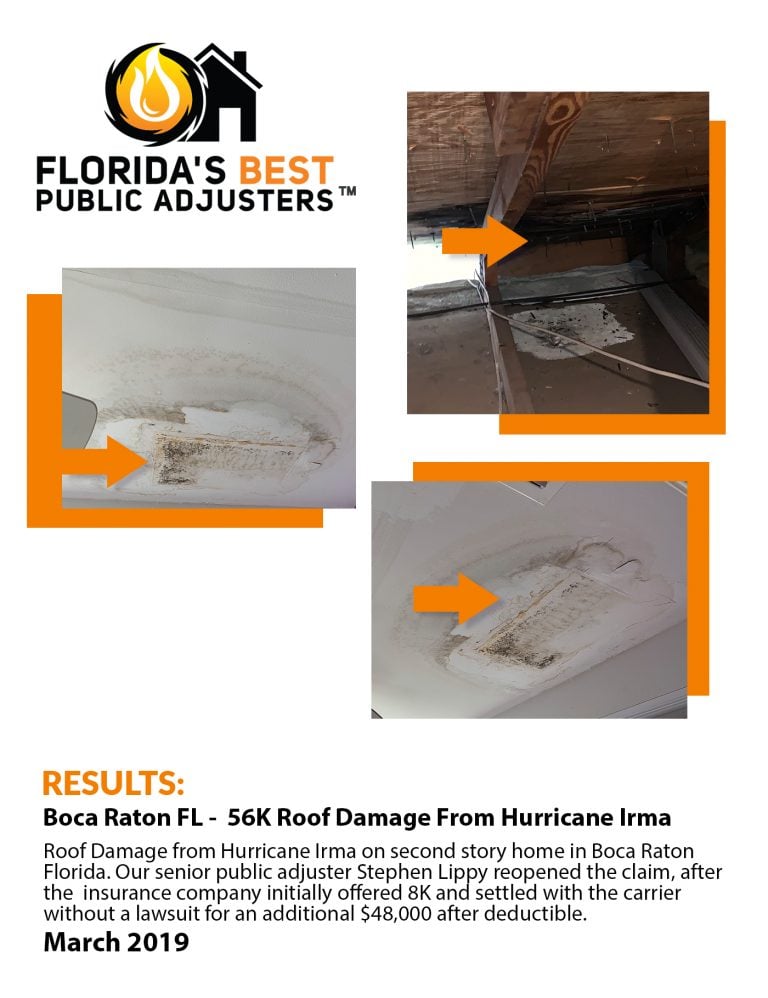

Case Study: $56,000 Roof Damage Claim Settlement in Boca Raton from Hurricane Irma

Irma left many homes in Boca Raton with significant damage, especially multi-story homes. One example was a roof damage claim, a two story home where the insurance offer was way off what was needed to fix the roof. That’s where a Boca Raton public adjuster made all the difference.

Initial Issues

After Irma, the homeowner received an initial offer of $8,000 from their insurance company. That was not enough to fix the roof of their severely damaged home. With a daunting process and an undervalued claim, the homeowner turned to senior Boca public adjuster Stephen Lippy, who has years of experience handling complex claims.

How a Boca Raton Public Adjuster Made a Difference

Stephen Lippy reopened the claim and used his experience to do a full reassessment of the damages. He documented the full extent of the hurricane’s damage, including areas missed by the original adjuster. His approach included:

-

A full analysis of the roof’s structure and damage.

-

A comparison of repair estimates to show the true cost of repair.

-

Negotiation with the insurance company with evidence.

By presenting a strong case without filing a lawsuit, Stephen Lippy was able to get an additional $48,000 on top of the initial offer, for a total settlement of $56,000. Now the homeowner can fix their roof and get their home back to pre-Irma condition.

What Do Insurance Inspectors Look for on Roofs?

During a typical roof inspection, insurance adjusters look for:

-

Roof’s age and installation quality: Was it built to code?

-

Damaged or missing shingles: A common result of high winds.

-

Signs of wear, sun damage and tree damage: Indicators of long term issues.

-

Nail pops and structural weaknesses: Indicators of deeper damage that can compromise the roof.

Does Insurance Pay for Roof Damage?

Homeowners insurance covers roof replacements when damage is caused by a natural disaster or an unexpected event. But normal wear and tear or gradual deterioration is not covered. For homeowners who need fair settlements after sudden damage, working with a Boca public adjuster is key. They make sure claims are valued correctly and help homeowners get the best results without the hassle of going it alone.

Results

This is what happens when you hire a Boca Raton public adjuster when your claim is underpaid or denied. The difference between an $8,000 initial offer and a $56,000 settlement is what a public adjuster can do for you.

If your Irma claim or any property damage claim was underpaid or denied, contact us today for a consultation and see how we can help you get paid.

In Short, a roof damage from Hurricane Irma on second story home in Boca Raton Florida. Our senior public adjuster Stephen Lippy reopened the claim, after the insurance company initially offered 8K and settled with the carrier without a lawsuit for an additional $48,000.

If your Hurricane Claim has been underpaid or denied, our experts public adjusters can help!